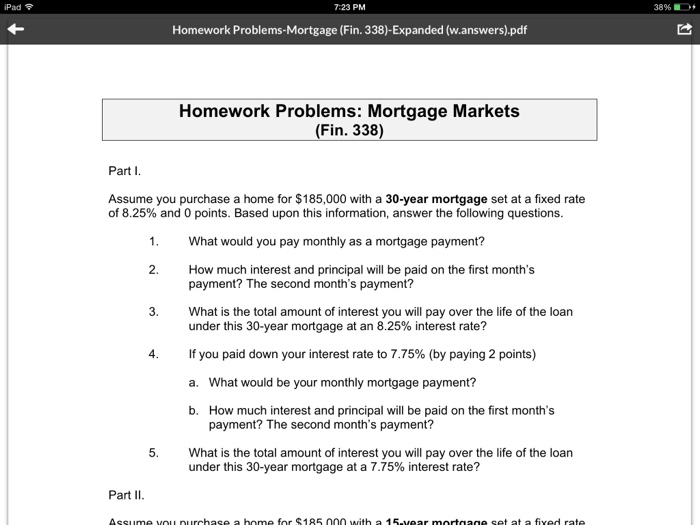

29+ how do you assume a mortgage

Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. Web A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home youre buying.

Assumable Mortgage What It Is And How It Works Lendingtree

Once the assumption is complete you take over the payments on a monthly basis and.

. Web In sum to assume a mortgage involves. The seller transfers the terms interest rates and mortgage balance. Web An assumable mortgage may be attractive to buyers when current mortgage rates are high and because closing costs are considerably lower than those.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web A person who assumes a mortgage takes over a payment from the previous homeowner. Web When you assume a mortgage loan it is essentially the same as a sale-purchase agreement.

Determining whether or not the mortgage loan is assumable. Web Ultimately what happens to your mortgage after you pass away greatly depends on state laws and what youve set up through your Estate Plan while youre still alive. Web An assumable mortgage allows a buyer to take over the sellers mortgage.

You typically have to pay closing. Web To assume a mortgage loan you must check whether your lender will permit an assumption and if so whether you qualify for the assumption. Basically the agreement shifts the financial responsibility of the loan to a different.

Updated FHA Loan Requirements for 2023. Compare Lenders And Find Out Which One Suits You Best. Comparisons Trusted by 55000000.

Web To assume a mortgage youll take many of the same steps you would if you applied for a new mortgage including completing an application and letting the. Ad Take the First Step Towards Your Dream Home See If You Qualify. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web You will need to complete an application provide credit and financial documents and get approved by the sellers lender to assume a mortgage. If assumption is allowed. Looking For Conventional Home Loan.

Web When you assume a mortgage loan it is essentially the same as a sale-purchase agreement. The seller transfers the terms interest rates and mortgage. Sending a request to assume the mortgage to the lender.

Web An assumable mortgage is simply put one that the lender will allow another borrower to take over or assume without changing any of the terms of the mortgage. Compare Lenders And Find Out Which One Suits You Best. Select Popular Legal Forms Packages of Any Category.

Looking For Conventional Home Loan. Check Your Official Eligibility Today. Ad 5 Best Home Loan Lenders Compared Reviewed.

All Major Categories Covered. For Your Unique Situation. Web To qualify for an assumable mortgage lenders will check a buyers credit score and debt-to-income ratio DTI to see if they meet minimum requirements.

Ad Create Your Release of Mortgage Lien in Minutes. If there is a. Comparisons Trusted by 55000000.

Assumable Mortgage Take Over Seller S Loan Bankrate

Solved Ipad 7 23 Pm Homework Problems Mortgage Fin Chegg Com

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Fixed Rate Mortgage How Does Fixed Rate Mortgage Work With Its Types

How Does Assuming A Seller S Mortgage Work Twg Blog

Expectations Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Free 7 Assignment Of Lease Forms In Pdf Ms Word

Understanding Assumable Mortgages Home Loans

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Find An Assumable Mortgage Pocketsense

Assumable Mortgage What Is It How Does It Work And Should You Get One Nerdwallet

Collateralized Mortgageobligation Advantages And Disadvantages

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage 10 Steps With Pictures Wikihow

10 Tips For Assuming A Mortgage How To Assume Mortgages Realestate Loans Leland Baptist Youtube

:max_bytes(150000):strip_icc()/parents-take-a-break-on-sofa-with-son-on-moving-day-635900900-5adc9ec46bf0690037a5955e.jpg)

Assumable Mortgage What Is It